Never in my life have I seen something like all the methods that are coming out to use in commodity price forecasting . There are many approaches and techniques . This chapter will present rather briefly, but a few .

There are some that are standard and this author will place an asterisk beside the ones which he personally uses . In this chapter alone there are approximately thirty-six ways and means of forecasting prices . This does not take into consideration the various great tidbits that can be found with a technical analysis course. ( I'm quite thrilled with P&L charting, for it lets this author on a daily basis and more be able to quantify price action. There is no other system I know of where more than trend or congestion the activity of the day means more in which the prices are being traded. Each day's activity through the use of P&L charting shows congestion or trend evolution , in some cases, in a day. ) Of course, , this author is most irritated by those traders who are convinced that their moving average, point and figure, resistance index, volume oscillator, balance volume, weighted moving averages , and who knows what else, - cash, basis , - are the only system which is effective. And, the system they use is the only one that will ever be effective and that they have no use for fundamentals, open interest, wave theories, chart patterns, point and figure, many others, and seem to be blind to approaches evolved by others. ( There . I was able to get that out.) Many times these traders do not even use their own systems and to me it seems, to always be fighting the market . If you assume the trader has gone through a technical analysis course and they have a plan for trading that combines various price forecasting methods and they are combined to help him profit from the market continually, then listening to this trader is a good idea . In the section on planning , the author will show his approaches to the market place and you will be surprised how flexible he is . In order to analyze commodity price behavior on the market, there are 3 methods . 1. fundamental 2. mechanical 3. technical FUNDAMENTAL In some cases the market ends up going opposite of considerations that are fundamental due to technical and other factors . Price movements in the long range are what the fundamental trader is interested in and must be prepared to wait it out . Fundamentalists may deny it , but you must take into account too many external factors , such as the natural response to fundamental influences , reflected in the fluctuations day by day . So for analysis, there is now reason to seek them out . MECHANICAL Methods that are mechanical use price and price alone to figure out what action to go with and this action does not require any decision on the part of the trader . There are three different methods. 1. chart 2. computer summaries 3. moving averages Going through a technical analysis course will teach that you should faithfully follow the trading rules and in most cases it's based on a formula that is mathematical to give you the trading time that is right. The computer tells you what a mathematical formula thinks you should do . One of the great things about using the mechanical method is that you can back check it . Computer oriented methods usually bias themselves towards mathematical trend analysis , using different trading systems, such as moving averages. The computer can be used as a chart reader and it can formulate and test any and all decision rules . TECHNICAL In the last several decades , a vast amount of work has been done to get technical tools in place , - all with the aim of anticipating futures prices from trading statistics , for example, volume, O.I. and price . There are four broad areas of the technical approach .

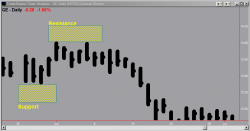

Technical analysis lists of various approaches can be cataloged by the following technical approaches .

Later there will be more discussion of this.

1 Comment

|

RSS Feed

RSS Feed