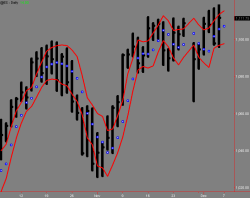

A technical analysis courseteaches that if you're able to make it through several years of commodity trading you will see every price pattern you will ever see ( look at that again ). All the rest of repetition of those patterns . One of the interesting things about trading in commodities is that as you watch markets move up , while others are at the bottom, (the end of bear markets) you can remind yourself " they'll be the next ones to go up ." Of course, Without doubt, the cycle is begun once again, from the top to the bottom and the bottom to the top . Prices will stop going down on all markets they move from side to side for awhile and then advance in price . One day there is always an end to bear markets in commodities , and there's always an end to bull markets .

What I've just talked about is representative of a long term philosophical approach to market price analysis . To put it simply, if in the past year or so the market prices have gone down , the bear market is coming to an end , and at some point all commodities will go back up . You don't even need a chart to realize this . However, when you look at charts by using a technical analysis course, you can see the bear trend is ending and the trader can take a position . It's not possible to use the assumption for trading that by looking at price movements generally by reading this in the news or just thinking about those movements, that it will help you in the long term to assume prices and the way they move. In most cases this approach won't allow you to restrict any limits on what you can lose once the market has been entered , because of negative price movements or after profits have been accumulated. Most individuals who do not use chart methods in an up market , for example, are surprised by a bear crack or trend. It's essential to have chart analysis to help keep profits protected and to protect against any losses! Enroll in a technical analysis course before you get involved with money.

0 Comments

It needs to be pointed out that as more people are participating in the market any attempt to predicate every action on chart rules , the affect that accumulates can cause fluctuations to occur which may take all chart techniques and make them virtually useless.

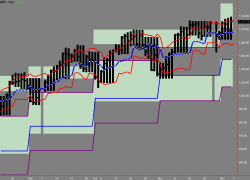

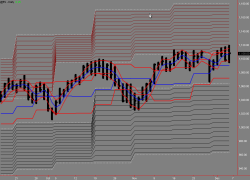

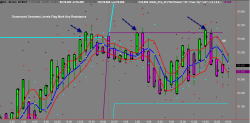

As a chartist, you have lots of company . Thousands of others are charting exactly the same movements as you are . When a big move is predicted, you are liable to have a lot of the same orders as yours hitting the trading pits . Particularly , stop loss orders being placed at the very same points by many chartists, may create false penetrations of trend lines and other formations . Charting is inevitably to some extent an inexact science , even for those chartists that have a technical analysis course under their belts . You can use on the chart scale used and whether to use closing or mid-price on it . To plot price movements , both can be distorted . Usually the latter is used most often , but since it happens at the end of the day a lot of profit taking and more is associated with it . Furthermore , chaos can occur to the charts because of events that are unforeseeable or changing. Charting is an approach that is a bit lazy . To some weaker people, the clinical and neat look on a piece of paper is appealing . Who have no penchant or time to try to dig deeper. Most feel it's more productive to look at all the variations. As there is a spread of technical analysis and more and more people take a technical analysis course, it will commence to defeat its own purpose , especially in a "thin" market setting. It is important to realize that is many traders are trading a commodity using usual chart interpretations , it can sway the commodity's price in the course chartists are expecting the prices to go . Chart followers are able to prove right their own theories. Pure chartists never want to know all about the fundamentals, a wise trader will try to combine futures trading from both strategies . There is no 100% reliable chart formation . Confirmation must be sought from various other indicators by chartists, such as production changes each year, business cycle variation, and deviation in commodity prices or any other quantifiable sum , brought down to a single summary figure to show all the activities. Often the commodity goes completely contrary to fundamental considerations due to technical and other factors . To thrive the chartist must be ready for thorough study and hard work and to develop more experience. Charting is an art due to the finesse and experience and the skill of a technician . These are no doubt profitable trading basic ingredients for success . A technician has to check, and check again . Another difficulty from charting is from the idea that although all the facts of a commodity situation are known to the speculator the same facts are known by many others who are professionals . In reality, however, unexpected events can occur and can affect every trader. These occurrences may not have totally discounted prices , which can catch chartists off guard and little can be done to keep your position protected except to recognize quickly these sudden changes and to act fast. ( Such as all the oranges being lost to a hurricane ). Technicians are famous for making spectacular profits one week and the next week take huge losses. It is a fact of life that prices don't change according to their performance in the past , although you do get some idea on a day to day basis with P&L charting . The advisability of most systems is indictable because there is no track record . All approaches have to be seen as unbeneficial until proof shows otherwise. To tell the truth , there's little actual evidence out there to support all the rules that come with chart analysis. Many chartists tend to anticipate trends . This is a fallacy . One cannot assume or recognize a trend that does not exist . If you want to utilize a trend with the method following, you have to wait until the demonstration of the trend has occurred. Even then, the motto a chartist needs to have is that a trend continues until it stops . Once again , he attempts to anticipate the direction of a trend reversal as it evolves . It is not possible. You can only realize an evolving trend as it happens. Trend reversals or trends can't even be anticipated by most technical systems either . If unexpected moves happen , most technicians have to begin again . After dealing with losses again and again, many traders have abandoned their technical studies because they just don't work . Because this happens on a regular basis, it continues to show that trading success has no short cuts and nothing substitutes for hard work, knowledge, and good experience . The fact that prices fluctuate is all we know for sure , but the amount of fluctuation isn't known. Only in congestion areas are you protected because this area helps to define the loss projections. Prices fluctuate in congestions . Using a technical approach that tries to take congestion areas and analyze them , and therein a trading method comes into being, will give the trader and the broker large profits, since commodity prices happen to be in congestion , more than 85% of the time in one form or another. The universal problem known to the professional and novice alike is when they need to get in or out of a market. Due to this, a technical analysis course will help you learn that technical analysis must to some degree encompass the short term price fluctuations ( Yes, another good plug for P&L charting ).  Technical analysis is for the short term. While technical indicators do not meet the test for medium or long term price projections, they are priceless when used in combination as consistent warning signs to alert U against short-term hazards. The entire objective of a technical analysis training course is to enable U to position U’reself in the market under favourable terms. Technical analysis must be short-term enough to enable U to exit the market when the trend to which U have committed U’reself develops an increasing potential for reversal. This is your new blog post. Click here and start typing, or drag in elements from the top bar.

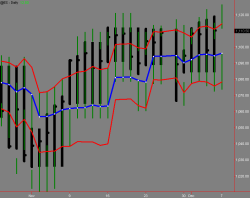

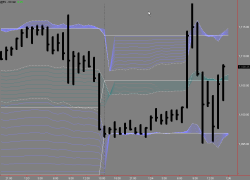

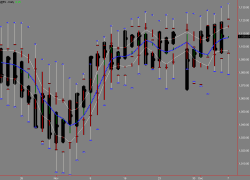

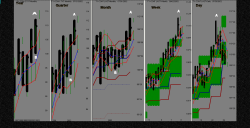

In order to ascertain price movement – momentum, one must apply technical analysis, and this technical analysis must be short term oriented. That is why I am delighted with the application of Point & Line Charting expressed further on in this book. There are myriads of approaches available to the trader. In the following section I will be listing but a few. The trader must accept those to which he is obliged to commit himself, based on his/her acceptance of them. His/her acceptance must flow from knowledge, experience and awareness. The fewer techniques U employ, the happier U will be. U will find however, Point & Line ( P&L ) Charting flows very well with any or all of these methods, because P&L charting is the penultimate in short-term day to day and intra-day analysis. I know of no system wherein that particular system analyzes market momentum, by taking into account the high/low/close of the specific day U wish to execute prices. However, the general medium to long term approaches, which includes fundamental analysis, enable the trader to be aware of price movements and identifying the broad picture. It is very important to be able to identify the ” picture ” in chart formation analysis. This is your new blog post. Click here and start typing, or drag in elements from the top bar.

A study of market action is an investigation of people inter-reacting with the market. Since we cannot insert people into test-tubes ( at least not yet ) to research their psychological make-up, we can only use proxies – - prices , which provide a means to measure the results of people’s reactions. Whatever one believes is being measured, the entire approach is being based on the assumption that certain repetitive patterns of price and action will re-occur, either before, during or after a significant price movement. To my mind, U shud have charts which clearly tell U the tale of the market and which wud be the most helpful to U in U’re forecasting ability. U’re chart is meant to be a road-map on the path to fortune. If it is too detailed, or pretends to do this, U mite as well frame it and hang it on the wall. Most charting systems contain the basic selling/buying pressure studies. This is your new blog post. Click here and start typing, or drag in elements from the top bar.

The chartist is always concerned with his ability to recognize the commencement of either a congestion area, a trend, or a trend reversal. So long as the trend line remains valid the market continues to parade in a succession of highs and lows. And, the prevailing trend is assumed to be intact. The penetration of a trendline cud raise the possibility of a reversal. The downside penetration of an uptrendline cud carry a bearish implication. In the reading of any chart formation, it is important that the underlying explanation of what is happening is held in mind. The “floor”,”ceiling”,”random walk”,”trending”,”discounting”, all help in the interpretation of charts. This is your new blog post. Click here and start typing, or drag in elements from the top bar.

The speculator need not be a statistician to trade in commodities successfully. In fact, more than one statistician has failed miserably in these markets when he attempted to apply his favorite model. The most expensive model in the world will not improve the actual, correct interpretation of the market. No system is that finite. The best systems always involve the writing down of the reasons why that system is applied, at a given time. The written statement must answer the statement ” Do U want to buy or sell this commodity”, reducing U’re reasoning to a simple statement or two, encompassing maybe the fundamental, technical and outside opinions, containing the outside opinion last in waying them least. Essentially however, market fundamentals underpin trend direction, while charts, volume waves, wiggle-waggles portray the market activity. There are two categories of analysis. 1 ) academic research – whether the markets are non – random or random etc. 2 ) practical market analysis This is your new blog post. Click here and start typing, or drag in elements from the top bar.

To be perfectly candid, there is very little objective, explicit evidence available to support the commonly accepted rules of chart analysis, yet the rules are widely accepted as valid and in many instances seem to produce worthwhile results. Chart signals are given by patterns built on many days’ price activity, which are often extremely difficult to define mathematically. This means that the chartist is essentially performing a highly complicated and subjective multiple correlation analysis in his mind as he examines his chart. When technicians attempt to focus attention on short-term fluctuations they leave themselves open to criticism. However, nearly all market analysis is based on short-term analysis, as an attempt-is made to find the appropriate moment to execute prices. The use of medium to long term price analysis will not take into account a random walk of a market on a medium to long term basis and the unpredictability of prices. Price is a result of a cause/effect relationship and occur at the wiggle of fingers in a trading pit. To assume an execution of a trading position based on medium to long term chart analysis does not take into account the effective impact of the character of the market as it relates to news events, trader’s commitments (who’s buying/selling), market psychology and other short term, small time-span factors. Fundamental analysis is the only justifiable approach to long term price analysis. |

RSS Feed

RSS Feed