The chartist can either take atechnical analysis course or personal study can be their method of learning. Many chartists have the argument "look at others...they probably have more knowledge on the basics than I do." Most chartists follow the tenet is "the trend continues until it stops." Many chartists try predicting a move in the trends. Chartists are famous for making spectacular profits one week and then they lose big time the next time. The chartist is always concerned with his ability to realize when a trend reversal or a congestion area is starting . As trends go on, chartists stay happy . If it looks like a trend is going to reverse, or there is a problem with a trend or the congestion area , then unhappiness occurs to the chartist.

Chartists are quite the characters . He really gets off on all the wiggle-waggles . Usually what happens to chartists is that he/she does not see the forest but for the trees . And, the chartist's bag of tools is never over-filled until that final moment when the noise of the information and systems clogs the channel of clear cogitation . He stares in blank, hypnotic, unreceptively for many hours at a chart , not realizing what the chart is saying . The big problem they have is that he/she looks towards the charts to tell him what prices are doing , instead of letting the charts know what he requires . A suggestion : When chartists come out of the fog , they need to request something from the chart and write it down. The chart is none other than the computer of facts and information , and like you do with a computer, one must punch in what one wishes the computer to start to tell him , and what criteria to use, and, this can only be done by a preprogrammed trading plan . The very first requirement a chartist has is that he has a plan for trading and extrapolates from the chart a criteria which is palatable to his plan . Investing in atechnical analysis courseis sound advice . Chartists that are successful are * a) not as likely to take a position that is long * b) before getting margin calls are more likely to close out their position. * c) less likely to put up additional margin if they do receive a margin call * d) more likely to trade in a larger number of commodities and to pyramid their profits . The unsuccessful chartist * a) has a clear tendency to cut their profits short while letting their losses run * b) less likely to be short than long * c) has a clear tendency to buy on days of price declines and to sell on price rises . This action indicates that these chartists are predominantly price level traders . Track records aren't possible on general chartists, but a track record is certainly feasible on the performance of any particular chartist . Unless chartists allow track records to be done on them, it is impossible to take their claims seriously . Few chart readers would have doubted the existence of the "head and shoulder" formation . However , the reversal signal of one will flag another to go on . More often than not , if a chartist is vindicated his market decisions were more often than not, a result of luck . The trader is more painfully aware that technical analysis course competence doesn't insure trading that is skilled. Chartists that lose their money do this not always because their analysis was bad but because of the inability to transform their analysis into sound practice . Getting over the gap that is between action and analysis means getting over the threat of fear, greed, and hope . Impatience has to be controlled and they must control the desire to go on to something new from a sound method , especially during time of temporary adversity .

1 Comment

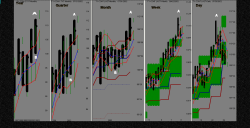

A technical analysis courseteaches that if you're able to make it through several years of commodity trading you will see every price pattern you will ever see ( look at that again ). All the rest of repetition of those patterns . One of the interesting things about trading in commodities is that as you watch markets move up , while others are at the bottom, (the end of bear markets) you can remind yourself " they'll be the next ones to go up ." Of course, Without doubt, the cycle is begun once again, from the top to the bottom and the bottom to the top . Prices will stop going down on all markets they move from side to side for awhile and then advance in price . One day there is always an end to bear markets in commodities , and there's always an end to bull markets .

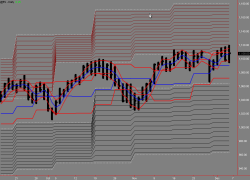

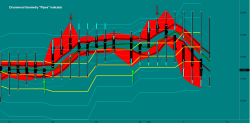

What I've just talked about is representative of a long term philosophical approach to market price analysis . To put it simply, if in the past year or so the market prices have gone down , the bear market is coming to an end , and at some point all commodities will go back up . You don't even need a chart to realize this . However, when you look at charts by using a technical analysis course, you can see the bear trend is ending and the trader can take a position . It's not possible to use the assumption for trading that by looking at price movements generally by reading this in the news or just thinking about those movements, that it will help you in the long term to assume prices and the way they move. In most cases this approach won't allow you to restrict any limits on what you can lose once the market has been entered , because of negative price movements or after profits have been accumulated. Most individuals who do not use chart methods in an up market , for example, are surprised by a bear crack or trend. It's essential to have chart analysis to help keep profits protected and to protect against any losses! Enroll in a technical analysis course before you get involved with money.  The chartist is always concerned with his ability to recognize the commencement of either a congestion area, a trend, or a trend reversal. So long as the trend line remains valid the market continues to parade in a succession of highs and lows. And, the prevailing trend is assumed to be intact. The penetration of a trendline cud raise the possibility of a reversal. The downside penetration of an uptrendline cud carry a bearish implication. In the reading of any chart formation, it is important that the underlying explanation of what is happening is held in mind. The “floor”,”ceiling”,”random walk”,”trending”,”discounting”, all help in the interpretation of charts. This is your new blog post. Click here and start typing, or drag in elements from the top bar.

|

RSS Feed

RSS Feed