Never in my life have I seen something like all the methods that are coming out to use in commodity price forecasting . There are many approaches and techniques . This chapter will present rather briefly, but a few .

There are some that are standard and this author will place an asterisk beside the ones which he personally uses . In this chapter alone there are approximately thirty-six ways and means of forecasting prices . This does not take into consideration the various great tidbits that can be found with a technical analysis course. ( I'm quite thrilled with P&L charting, for it lets this author on a daily basis and more be able to quantify price action. There is no other system I know of where more than trend or congestion the activity of the day means more in which the prices are being traded. Each day's activity through the use of P&L charting shows congestion or trend evolution , in some cases, in a day. ) Of course, , this author is most irritated by those traders who are convinced that their moving average, point and figure, resistance index, volume oscillator, balance volume, weighted moving averages , and who knows what else, - cash, basis , - are the only system which is effective. And, the system they use is the only one that will ever be effective and that they have no use for fundamentals, open interest, wave theories, chart patterns, point and figure, many others, and seem to be blind to approaches evolved by others. ( There . I was able to get that out.) Many times these traders do not even use their own systems and to me it seems, to always be fighting the market . If you assume the trader has gone through a technical analysis course and they have a plan for trading that combines various price forecasting methods and they are combined to help him profit from the market continually, then listening to this trader is a good idea . In the section on planning , the author will show his approaches to the market place and you will be surprised how flexible he is . In order to analyze commodity price behavior on the market, there are 3 methods . 1. fundamental 2. mechanical 3. technical FUNDAMENTAL In some cases the market ends up going opposite of considerations that are fundamental due to technical and other factors . Price movements in the long range are what the fundamental trader is interested in and must be prepared to wait it out . Fundamentalists may deny it , but you must take into account too many external factors , such as the natural response to fundamental influences , reflected in the fluctuations day by day . So for analysis, there is now reason to seek them out . MECHANICAL Methods that are mechanical use price and price alone to figure out what action to go with and this action does not require any decision on the part of the trader . There are three different methods. 1. chart 2. computer summaries 3. moving averages Going through a technical analysis course will teach that you should faithfully follow the trading rules and in most cases it's based on a formula that is mathematical to give you the trading time that is right. The computer tells you what a mathematical formula thinks you should do . One of the great things about using the mechanical method is that you can back check it . Computer oriented methods usually bias themselves towards mathematical trend analysis , using different trading systems, such as moving averages. The computer can be used as a chart reader and it can formulate and test any and all decision rules . TECHNICAL In the last several decades , a vast amount of work has been done to get technical tools in place , - all with the aim of anticipating futures prices from trading statistics , for example, volume, O.I. and price . There are four broad areas of the technical approach .

Technical analysis lists of various approaches can be cataloged by the following technical approaches .

Later there will be more discussion of this.

1 Comment

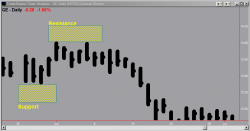

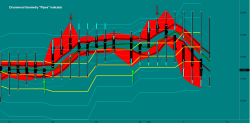

The chartist can either take atechnical analysis course or personal study can be their method of learning. Many chartists have the argument "look at others...they probably have more knowledge on the basics than I do." Most chartists follow the tenet is "the trend continues until it stops." Many chartists try predicting a move in the trends. Chartists are famous for making spectacular profits one week and then they lose big time the next time. The chartist is always concerned with his ability to realize when a trend reversal or a congestion area is starting . As trends go on, chartists stay happy . If it looks like a trend is going to reverse, or there is a problem with a trend or the congestion area , then unhappiness occurs to the chartist.

Chartists are quite the characters . He really gets off on all the wiggle-waggles . Usually what happens to chartists is that he/she does not see the forest but for the trees . And, the chartist's bag of tools is never over-filled until that final moment when the noise of the information and systems clogs the channel of clear cogitation . He stares in blank, hypnotic, unreceptively for many hours at a chart , not realizing what the chart is saying . The big problem they have is that he/she looks towards the charts to tell him what prices are doing , instead of letting the charts know what he requires . A suggestion : When chartists come out of the fog , they need to request something from the chart and write it down. The chart is none other than the computer of facts and information , and like you do with a computer, one must punch in what one wishes the computer to start to tell him , and what criteria to use, and, this can only be done by a preprogrammed trading plan . The very first requirement a chartist has is that he has a plan for trading and extrapolates from the chart a criteria which is palatable to his plan . Investing in atechnical analysis courseis sound advice . Chartists that are successful are * a) not as likely to take a position that is long * b) before getting margin calls are more likely to close out their position. * c) less likely to put up additional margin if they do receive a margin call * d) more likely to trade in a larger number of commodities and to pyramid their profits . The unsuccessful chartist * a) has a clear tendency to cut their profits short while letting their losses run * b) less likely to be short than long * c) has a clear tendency to buy on days of price declines and to sell on price rises . This action indicates that these chartists are predominantly price level traders . Track records aren't possible on general chartists, but a track record is certainly feasible on the performance of any particular chartist . Unless chartists allow track records to be done on them, it is impossible to take their claims seriously . Few chart readers would have doubted the existence of the "head and shoulder" formation . However , the reversal signal of one will flag another to go on . More often than not , if a chartist is vindicated his market decisions were more often than not, a result of luck . The trader is more painfully aware that technical analysis course competence doesn't insure trading that is skilled. Chartists that lose their money do this not always because their analysis was bad but because of the inability to transform their analysis into sound practice . Getting over the gap that is between action and analysis means getting over the threat of fear, greed, and hope . Impatience has to be controlled and they must control the desire to go on to something new from a sound method , especially during time of temporary adversity . |

RSS Feed

RSS Feed