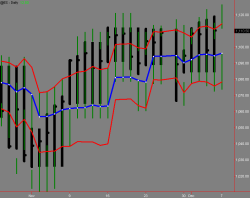

Learning About Moving Averages with a Technical Analysis Course Most models are based upon a system of moving averages . Some are difficult and include many unknowns. A bead is drawn on a trend direction by most models after it has been manifested and will keep you in the market as long as the trend is unchanged . A few moving averages try to forsee trend changes . These ones can be lucrative to a good trader that can initiate a position that is recommended and can underlie more losing than winning trades . A technical analysis course shows that the thought behind moving averages ( MA ) is figuring when the price direction differs from recent price averages. As long as the price average is lower than the current price of the last 10 days, 20 days, or even 90 days the trend continues . The most ordinarily observed average is the 10 day MA of the closing prices. The benefit of this method is that the same weight is given to the price of each day. The assumption of the MA is that yesterday's prices and those from last week get the same importance with a trader. This doesn't stick to reality . A short term trader's horizon is extremely limited . Commodity prices do vibrate more rapidly than the prices of most other investment forms , therefore, a shorter series usually performs best . An ideal MA should : 1) should be able to observe a major turn of a price trend at once and not several days after the turn 2) we do not want the MA plot so close to the plots of the daily prices that we get lashed into consolidation or minor swings. 3) the moving MA plot has to be adjustable to the commodities volatility . 4) if the commodity locks limit the MA plot should be responsive . The short comings to this approach is that moving average lines may be too languid to use as a reversal indicator . Most of the time, MA technicians have their trading decisions guided by changes in the price market relative to the moving average line . As the MA is more sensitive the smaller the degree and amount of the advance differential and the larger the number of sell and buy points , resulting in much whip-saw and consequent small losses as taught by a technical analysis course. Of course , the shorter time span there is , the more the MA is sensitive to a reversal or trend termination . New trends will be acted on earlier and don't need as much time to get established . Yet , tarders usually pay for the sensitivity because, and to repeat , the shorter the MA the larger the trades that are made with the addition of greater commissions to the whip-saw losses . This means, moving averages has a delay in showing price trend turns. Many times the delay is much greater than would be the case using P&L charting, simple charts, or point and figure charting . The main advantage of this position is that the each trend of substance has the user automatically put on board ( as do all systems of trend following .) More can be found out from a technical analysis course.

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed